By: Al Moutassim Alkilani and Rania Kisar

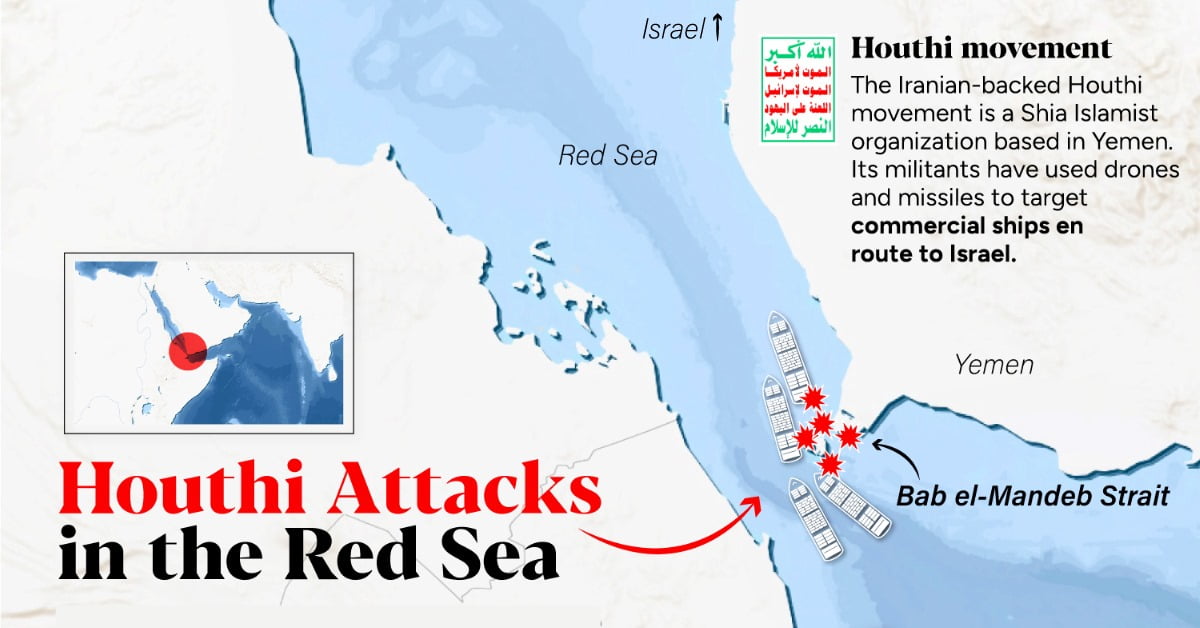

In a recent ACLS podcast, Dr. Daniel Melhem, a prominent economic researcher and Professor of International Economics in Paris, was invited to discuss the economic impact of the Houthi attacks. Dr. Melhem highlights the critical importance of the Red Sea’s Bab el-Mandeb Strait, a key maritime choke point. He notes that the ramifications of the Iranian-backed Houthi attacks extend well beyond regional security concerns, affecting major global economies, including Europe and the United States. Dr. Melhem analyzes the wider consequences of these assaults for the geopolitical landscape, essential global supply chains, and overall economic stability.

Europe & The United States

Dr. Melhem underscores how the Red Sea attacks affect Europe and the U.S. Europe relies on this passage for 40% of its trade with China and 60% of petroleum imports, mainly from Qatar and Saudi Arabia. With Europe diversifying its oil sources away from Russia towards India, the Bab el Mandeb strait’s stability is paramount for European interests. Disruption risks exacerbating global price surges and inflation, potentially more severe than current inflation rates in the U.S. Although the U.S. remains less directly affected, thanks to increased domestic production and reduced reliance on Southeast Asian imports, except South Korea, the strategic importance of the Bab al-Mandab Strait remains undeniable for U.S. interests as well.

Delving deeper into the economic ramifications, Dr. Melhem cautions that prolonged transit times – up to 34 days to Europe and an additional 14 to the U.S. – due to disruptions in the Bab al-Mandab Strait will inflate shipping costs. The price for a 40-foot container from China to France now ranges from $7,000 to $8,000, increasing operational expenses by an estimated $30 million per vessel. Consequently, this situation could elevate inflation by 0.7% in the U.S. and 0.9% in Europe, while potentially reducing economic growth by 0.6% in the U.S, 1.1% in Europe, and 0.3% in China, affecting China as an exporter.

The attacks have also led to a sharp rise in ship insurance rates, escalating from 0.025% to as high as 0.7% of a ship’s value. At these elevated insurance rates, for a $100 million ship, insurance costs can reach approximately $700,000. These increased insurance expenses, along with higher fuel and crew wages, significantly increase the total operational costs of shipping. The extended transit time to destinations further adds to these costs.

Currently, the impact on commodity prices is gradual but will likely become more pronounced in the next three months, as production cost hikes typically take around three months to affect consumer prices.

In regions like Europe and the U.S., demand dynamics play a vital role. The U.S., with its robust consumer demand, maintains high consumption levels. The Mano Victor Index reveals a critical shortage in U.S. Diffuse Inventories, standing at about 0.4 – less than half the optimal level. This shortage in raw materials and semi-finished goods, coupled with high demand, risks escalating inflation.

Markets currently expect the US Federal Reserve to reduce interest rates, assuming inflation drops to around 2%. However, a potential rise in inflation, reminiscent of the late 1970s to early 1980s, could lead to increased rates, disrupting financial markets accustomed to lower rates. The U.S. bond market is a concern, with U.S. national debt at $34 trillion and debt service costs projected at $1.1 trillion for 2024, contributing to a forecasted $1.5 trillion federal deficit. Treasury Secretary Janet Yellen suggests that lower interest rates could reduce these figures, but an increase could prompt a Federal Reserve reassessment. Extended high interest rates would force the U.S. government to reevaluate its budget and spending, potentially enlarging the deficit and intensifying public debt concerns, especially as debt service alone currently represents over 17% of U.S. government spending.

In Europe, low consumer demand has led to stagnant corporate profits and rising inflation, potentially impacting corporate earnings and consumer costs. The European Central Bank (ECB) may not lower interest rates in response, as this approach is less effective against supply shock issues. Dr. Melhem believes the ECB will wait for the U.S. Federal Reserve to act first, a historical trend. Europe’s economic challenges differ from the U.S., but are less likely to result in severe outcomes due to the ECB’s more flexible monetary policy and the U.S.’s strong consumer demand, high public spending, and significant debt, which makes the latter more economically sensitive.

Globally, markets remain highly sensitive to geopolitical tensions, particularly in oil prices. European oil markets include a higher risk premium of about three dollars per barrel due to geopolitical tensions, compared to around 1.1 dollars in the U.S. This shows the U.S. is less affected by tensions in the Red Sea region than Europe.

While current investor perception of risk in oil markets is low, there is growing concern about future risks. Global markets, encompassing financial and energy sectors, do not see the Red Sea situation as an immediate threat but acknowledge its potential future significance if it becomes a longer-lasting crisis, especially for supply chains between Southern and Northern countries.

The Middle East

In the Middle East, the Iranian-led Houthi attacks have notably disrupted Israel’s imports from China via the Red Sea, leading Israel to increase imports from Turkey by 400%. Egypt’s Suez Canal also faced a severe dropoff in crossings and associated revenues. Gulf countries, with exporting ports beyond Bab el-Mandeb, remained largely unaffected.

Beyond exports, however, the Houthi attacks pose long-term strategic challenges to regional stability in the Gulf region. Saudi Arabia, keen on avoiding conflict and focusing on economic growth, was not targeted in these attacks, but is suffering from a general pullback of foreign investment as a result of the regional crisis.

Saudi Arabia is undergoing significant political and economic transformations, with initiatives like the Saudi Expo and strategic plans for 2027 and 2030. The Kingdom is strengthening its mining sector and moving towards clean energy, aspiring to be a central hub for alternative energy and mining, positioning itself as an alternative to Southeast Asia. Regional tensions pose risks to Saudi ambitions.

Dr. Melhem believes that in the context of U.S.-Saudi relations, the U.S. in previous years has maintained neutrality in the conflict between the Houthis and Saudi Arabia, signaling to the Houthis a lack of direct U.S. involvement. He believes this US stance makes it unlikely for the Houthis to target American interests more broadly, as they tend to avoid engaging with non-involved countries.

The Houthis, influenced by Iran, have avoided targeting Chinese or Russian interests in the Red Sea, presumably to preserve Iran’s relationships with these nations. Dr. Melhem thinks Iran, influencing Houthi actions, seeks to maintain stable ties with Saudi Arabia.

This situation could change rapidly if American bases in the Arab Gulf or interests in the NEOM area or UAE were attacked, which would mark Yemen as a strategic threat to Arab Gulf policies. This could lead to potential military action against Yemen by the Arab Gulf countries, though this seems unlikely due to the risk of escalating the conflict and the complex U.S. involvement in the region. Melhem also judges that the Yemen conflict is connected to the Gaza conflict, and thus a cessation in Gaza could lead to reduced tensions in the Red Sea.

Recommendations:

Dr. Melhem thinks the Red Sea crisis will accelerate some emerging strategic economic trends on issues like alternative energy, climate change, and supply chain disruptions. In the U.S., a strategic shift is occurring, especially in the semiconductor industry, with major investments planned, potentially reaching $800 billion. Companies like ABC and Samsung are building new facilities in the U.S., signaling a move towards less dependence on Taiwan and other East Asian producers.

The U.S. is reducing its dependence on non-essential imported goods, focusing instead on domestic production of strategic items like batteries. This is part of a global trend of technology companies relocating from China to regions aligned with U.S. interests, leading to a reorganization of the global economy into three main blocs: the U.S., China with South and East Asia, and Europe.

Europe is looking to nearby regions for essential resources, particularly green energy from places like Saudi Arabia. This global shift is expected to cause disruptions over the next decade, raising questions about the future of the global financial system and the strategic importance of materials essential for industries like batteries and solar panels.

The current crisis shows that even minor players like the Houthis, despite their size and limited high-tech tools, can significantly impact global stability. Dr. Melhem concludes that this situation reflects insufficient international cooperation and a poor understanding of the global economic system.

Melhem sees a global shift from economically driven policies to ideologically driven ones, as seen in China’s evolution under Xi Jinping’s economic strategy. He believes ideological trends are also rising in Europe and the U.S., suggesting a drift toward ideological tensions. Meanwhile, international economic forums have been focusing on advanced topics like AI, while neglecting these ideological trends and neglecting the needs of Southern countries, leading to a redivision of global blocs. His overall sense is that the global disruption we are seeing as a result of the Red Sea crisis could be a harbinger of more global disturbances to come.